estate tax return due date 1041

The gift tax return is due on April 15th following the year in which the gift is made. Form 1041 - Return Due Date.

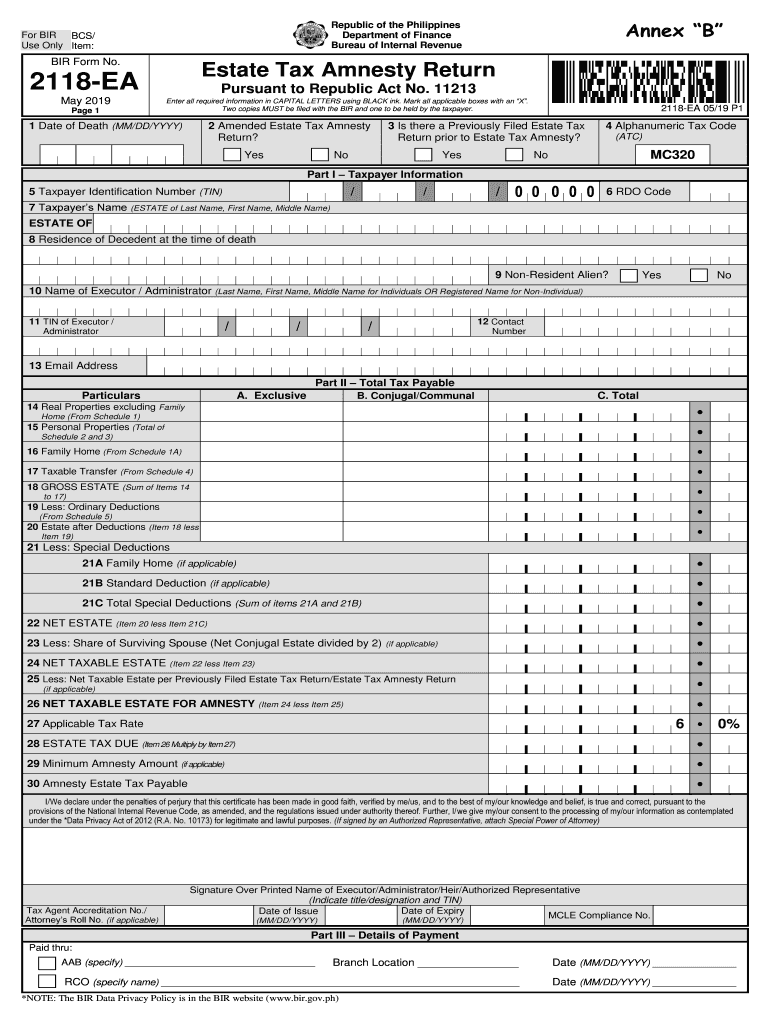

Estate Tax Amnesty Return Fill And Sign Printable Template Online Us Legal Forms

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

. An estate income tax return is an annual filing which taxes the income generated by the estate in the taxable year. The estates initial income-tax year begins immediately after the date of death. 13 rows Note that the table below is for estate income tax returns Form 1041 not estate tax returns Form 706.

Calendar year estates and trusts must file Form 1041 by April 18 2022. Whereas an estate tax return is a one-time transfer tax on the value of the assets owned by a decedent at their death and are due nine. Income Tax Return for Estates and Trusts and Schedule K-1 Beneficiarys Share of Income Deductions Credits etc.

If you live in Maine or Massachusetts you have until April 19 2022. Before filing Form 1041 you will need to obtain a tax ID number for the estate. The beneficiaries would report the income from their K-1s on their 2020 income tax returns.

The decedent and their estate are separate taxable entities. Estate elected calendar year so return for 2020 was due 4152021. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbia even if you dont live in the District of Columbia.

IRS Form 1041 US. Federal estate tax returns are due no later than 9 months after the. If the Form 1041 deadline slipped your mind or you just realized you need to file there is still time to request an extension.

For fiscal year estates file Form 1041 by the 15th day of the 4th month following the close of the tax year. Generally the estate tax return is due nine months after the date of death. The Illinois Estate and Generation-Skipping Transfer Tax Act 35 ILCS 4051 et seq may be found on the Illinois General Assemblys website.

Filing an income tax return for the 2021 calendar year Form 1041 or filing for an automatic five-and-a-half-month extension to September 30 Form 7004 and paying any income tax due. The upcoming April 15 2021 income tax deadline doesnt only apply to businesses. Following the closure of a trust or estates tax year forms 1041 must be filed by the fifteenth day of the fourth month after the close of the tax period.

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months. Additionally it is due on the same date as your individual income tax return Form 1040. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 --10-JUL-2020.

During the tax year did the estate or trust receive a distribution from or was it the grantor of or transferor to a. Many charitable trusts and recipients of trusts and estates are required to file Form 1041 by this due date. For those filing Form 1040 Schedule H is to be submitted with the return and is thus extended to the due date of the return.

For calendar-year file on or before April 15 Form 1041 US. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. For fiscal year estates and trusts file Form 1041 and Schedules K-1 by the 15th day of the 4th month following the close of the tax year.

Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021. For calendar-year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 2019. For fiscal year file by the 15th day of the fourth month following the tax year close Form 1041.

For example an estate that has a tax year that ends on June 30 2019 must file Form 1041 by October 15. What is the due date for IRS Form 1041. For calendar year estates and trusts file Form 1041 and IRS Schedule K-1 on or before tax day.

A trust or estate with a tax year that ends June 30 must file by October 15 of the same year. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. The income on a K-1 1041 is reported by a beneficiary in the same year end as indicated on the K-1 in this instance that would be the 2020 calendar year ending 12312020.

13 rows Note that the table below is for estate income tax returns Form 1041 not estate tax. In a tax year ending December 31 is due April 15 if the trust or estate has its tax year ending May 31. Correction to the 2020 Instructions for Schedule K-1 Form 1041 -- 15-JUL-2021.

Form 1041. More Help With Filing a Form 1041 for an Estate. Table assumes owner is calendar-year individual.

For other forms in the Form 706 series and for Forms 8892 and 8855 see the related. Form 1041 income tax return for estates and trusts is due April 15th July 15th for 2019 Fed 1041 and see link below for state dues for 2019 for calendar year estatestrusts or by the 15th day of the 4th month following the close of the tax year for fiscal year estatestrusts. Due date of return.

An estates tax ID number is called an employer identification. Single-member limited liability company SMLLC uses same due date and extended due date as its owner. What Is The Due Date For Form 1041.

The gift tax return is due on April 15th following the year in which the gift is made. For trusts operating on a calendar year the trust tax return due date is April 15. An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of.

IRS Form 1041 US. If line 26 is smaller than the total of lines 24 25 and 27 enter amount owed. Income tax of trust estate RI-1041 April 18 2022 Includes nonresident returns on Form RI-1040NR.

The return is due by the 15th day of the fourth month after the tax year end adjusted for weekends and holidays. The decedent and their estate are separate taxable entities. Form 1041 is due by the fifteenth day of the fourth month after the close of the trusts or estates tax year and can be sent either electronically or by post.

Income Tax Return for Estates and Trusts and Schedule K-1 Beneficiarys Share of Income Deductions Credits etc. Income Tax Return for Estates and Trusts. The tax year end can be December 31 or the end of any other month that results in an initial tax period of 12 months or less.

When is Form 1041 Due. For example for a trust or estate with a tax year ending December 31 the due date is April 15 of the following year.

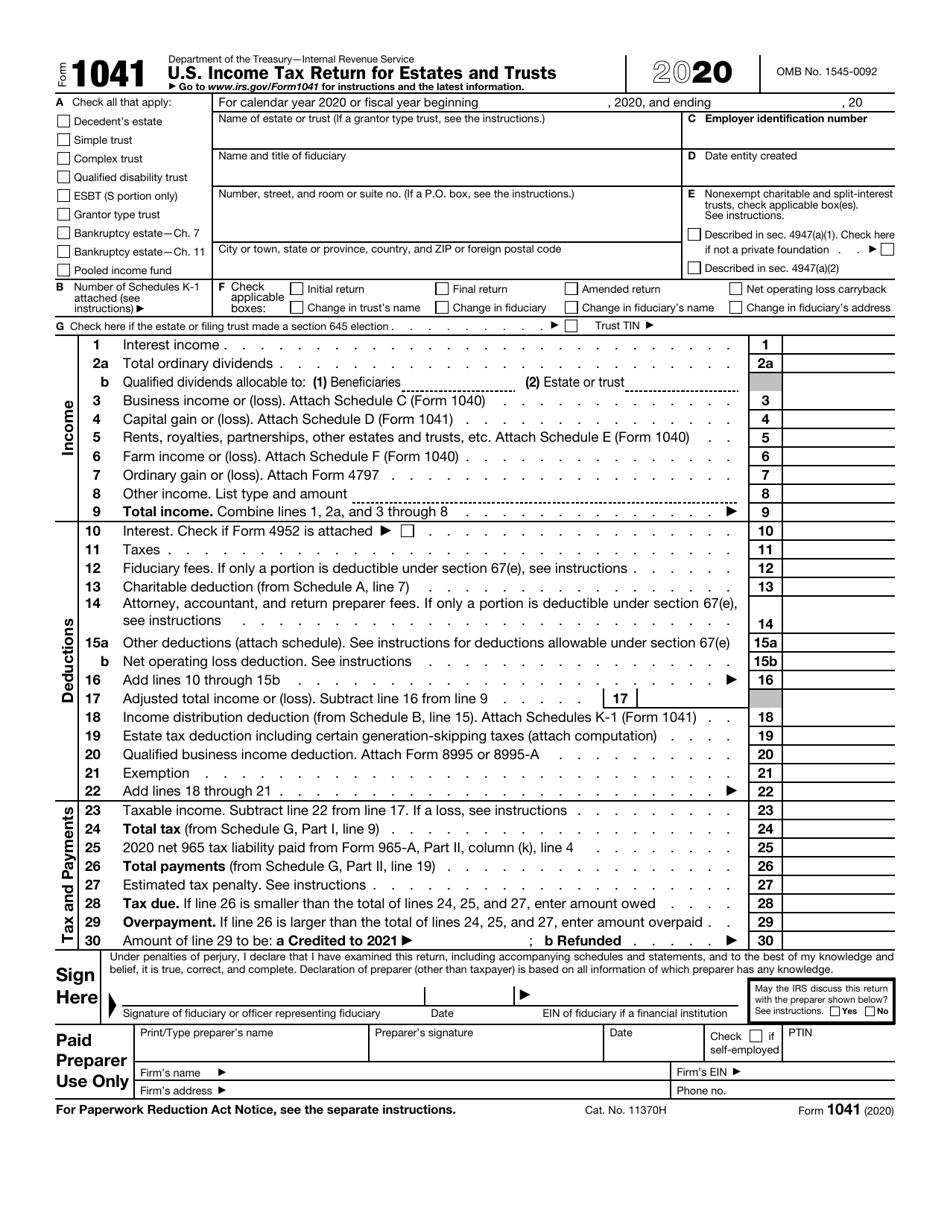

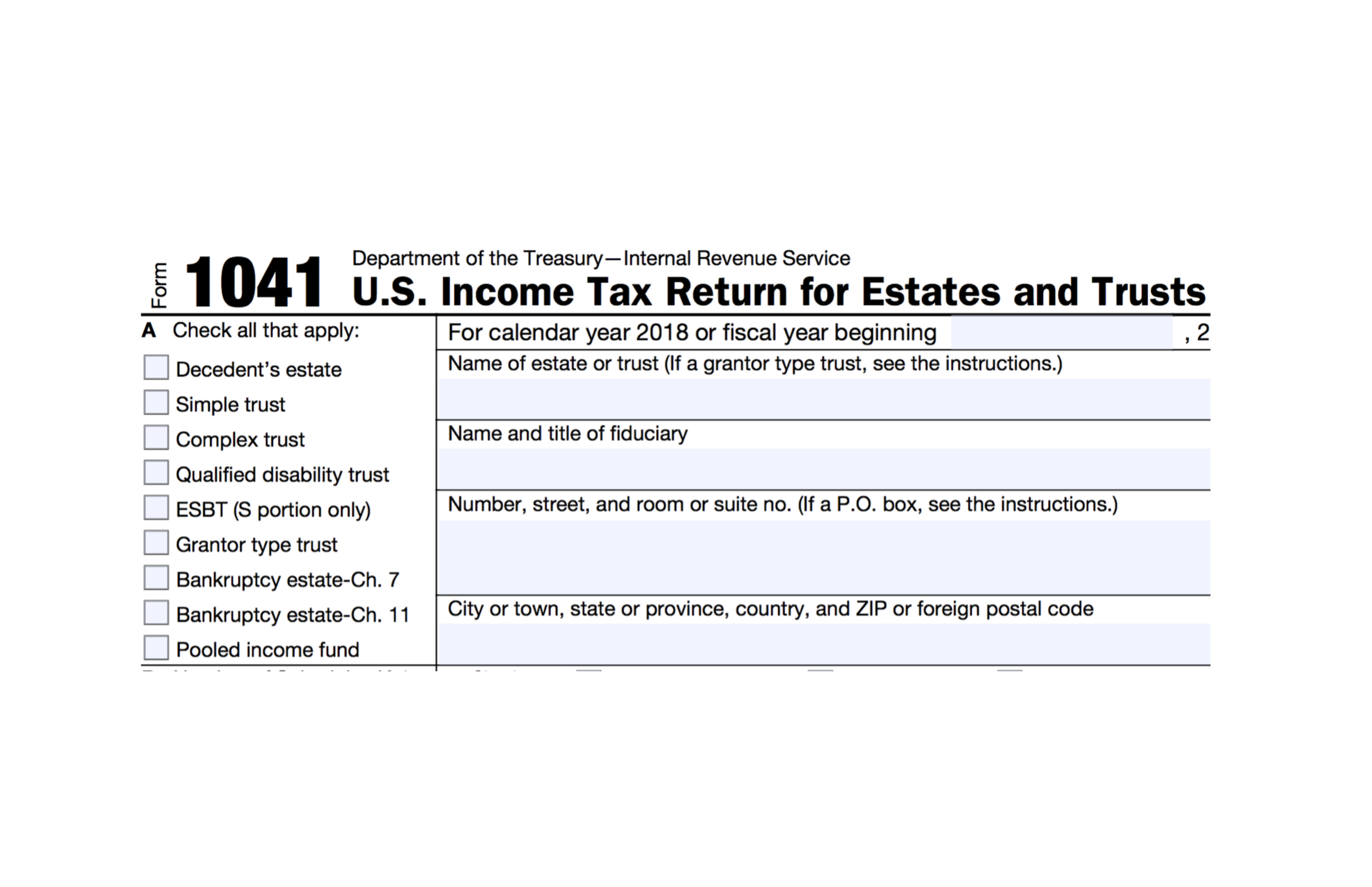

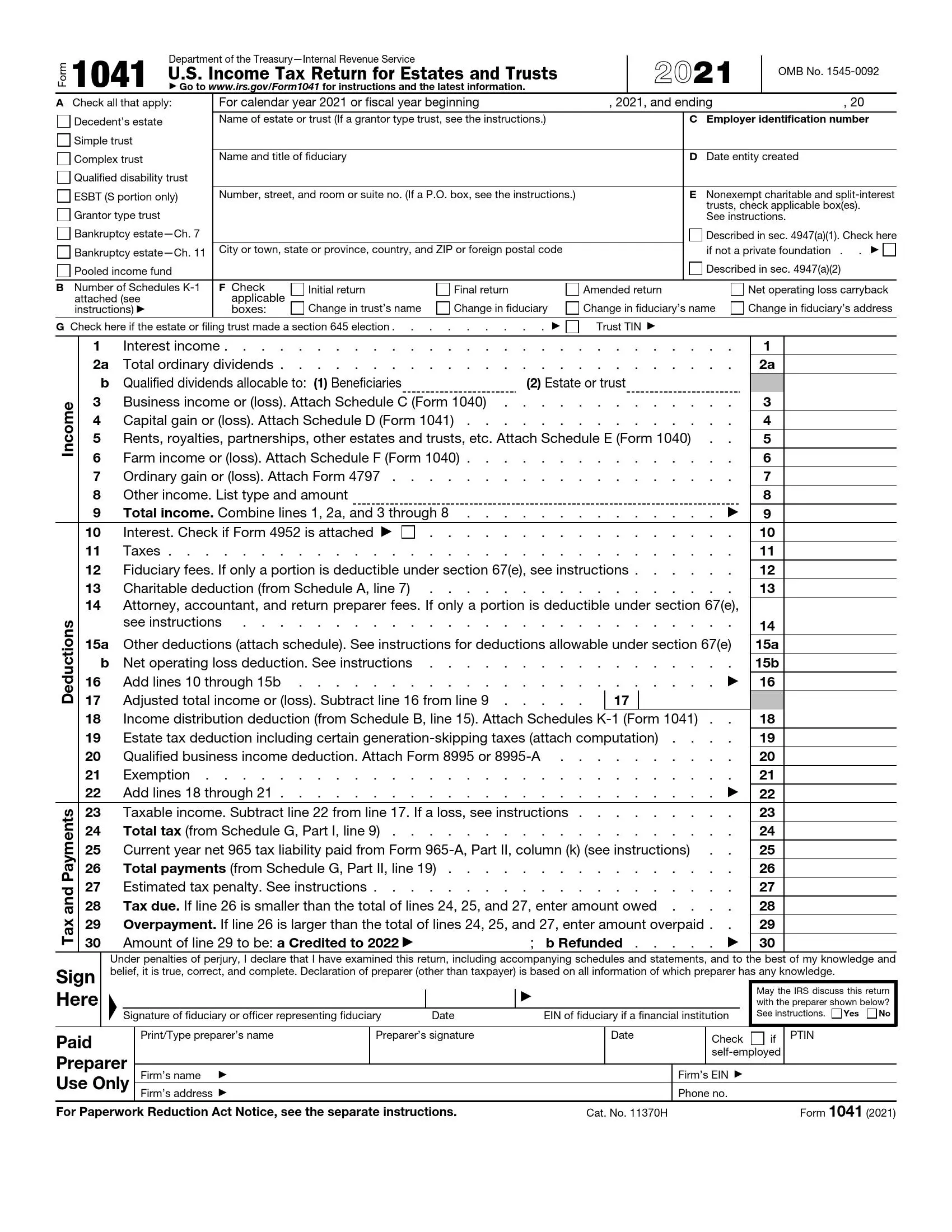

Irs Form 1041 Download Fillable Pdf Or Fill Online U S Income Tax Return For Estates And Trusts 2020 Templateroller

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

The Estate Tax On Stocks And Dividends Intelligent Income By Simply Safe Dividends

Irs Form 1041 Fill Out Printable Pdf Forms Online

Filing Taxes For Deceased With No Estate H R Block

Exploring The Estate Tax Part 2 Journal Of Accountancy

Properly Preparing The Form 706 Estate Tax Return A 2 Part Series Ultimate Estate Planner

Estate Tax Information Noevalleylaw

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The Basics Of Fiduciary Income Taxation The American College Of Trust And Estate Counsel

U S Income Tax Return For Estates And Trusts Form 1041

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Estate Income Tax Return When Is It Due

Estate And Trust Tax Return Organizer Form 1041

Form 1041 U S Income Tax Return For Estates And Trusts Form 1041

Irs Form 1041 Estates And Trusts That Must File Werner Law Firm

When To File Form 1041 H R Block

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide